Ranked in the Top 10 of Top 50 UK Ground Consultants for a second year in a row

Ayesa maintains its position in the UK's top 10 Ground Consultants for the second year in a row.

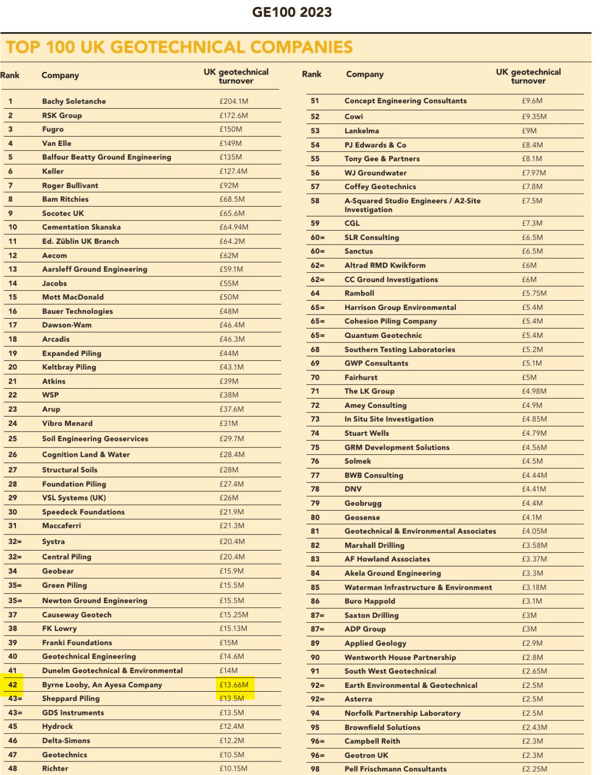

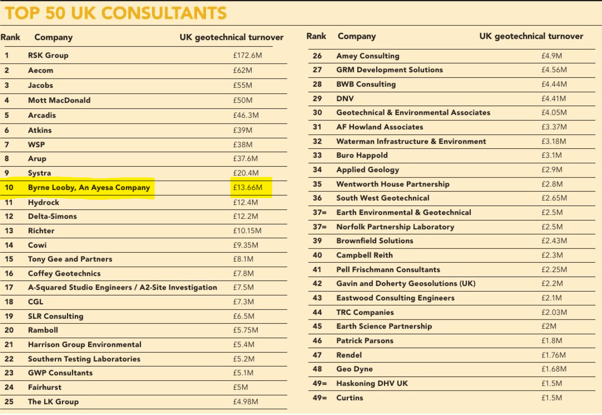

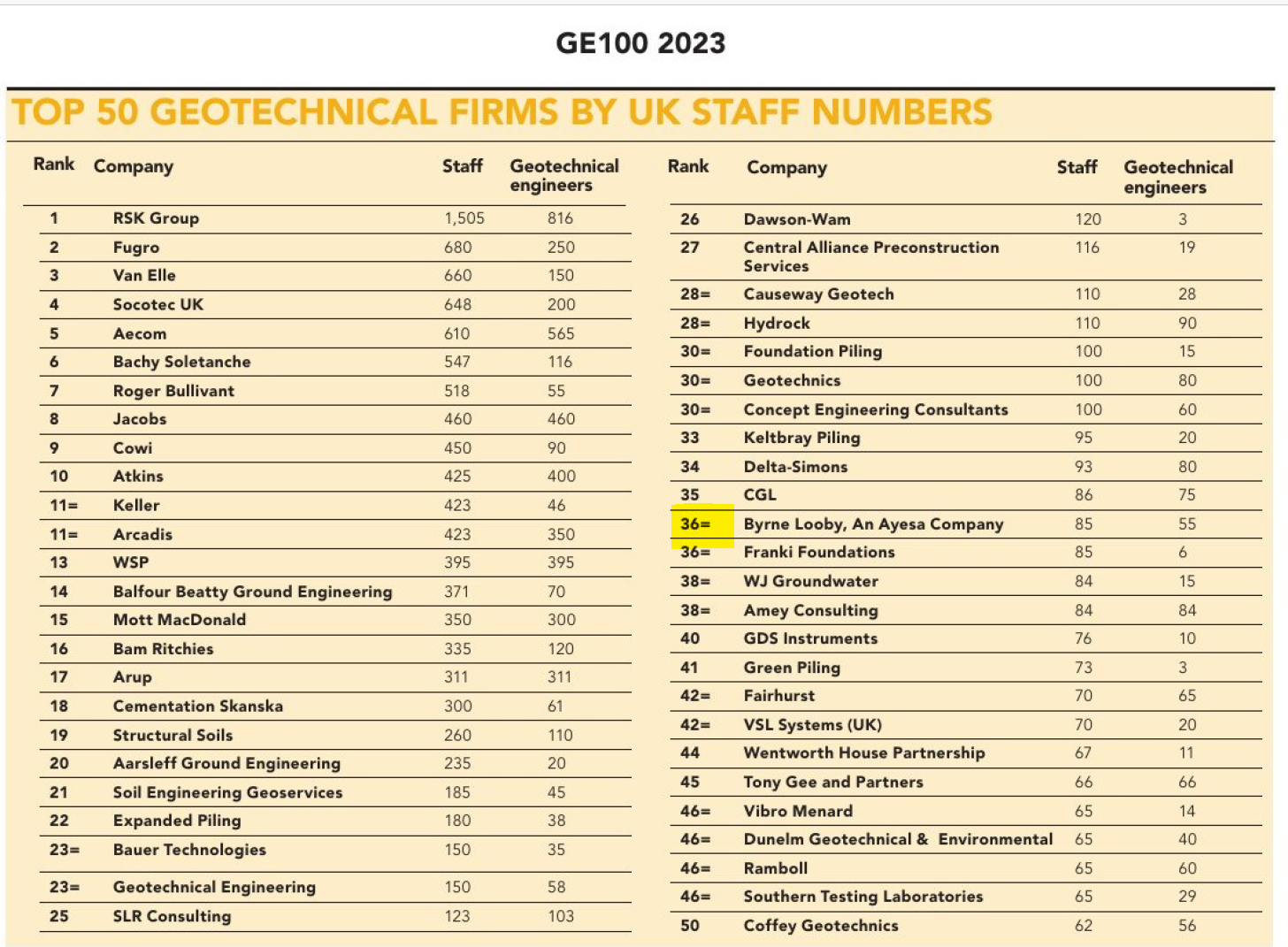

Once again, demonstrating its leading technical expertise as a ground engineering consultant, ByrneLooby-Ayesa has been ranked in the top 10 of the UK's GE100 for two consecutive years. The long-running league table, drawn from the UK Ground Engineering Magazine's survey, includes facts and figures from the top geotechnical and geo-environmental companies and provides a barometer to measure the best in the sector.

- For 2023, ByrneLooby-Ayesa ranks number 10 in the UK’s top 50 consultants according to revenue.

- The company is ranked 36 among the Top 50 geotechnical firms by UK staff numbers.

- ByrneLooby-Ayesa is ranked 42 out of the Top 100 UK Geotechnical companies (includes both contractors and consultants revenue figures)

The survey also gets to the heart of the industry's critical issues with insights and analysis into the latest developments in the geotechnical and geo-environmental sectors. Read the full GE100 survey and accompanying analysis here.

WE SUMMARISE THE KEY TAKE-OUTS FROM THE 2023 SURVEY AS POWER AND WATER SCHEMES TAKE CENTRE STAGE FOR SECTORAL GROWTH

We summarise the key takeaways from the 2023 survey here:

Powering Forward: According to almost 70% of respondents, the energy industry is expected to experience rapid growth. That’s nearly 10% up from last year. Great British Nuclear (GBN) plays a large part, with projects such as the ongoing Hinkley Point C and recently approved Sizewell C driving activity. An increase in wind, solar, and even geothermal are also helping to inspire confidence that this vertical will provide plenty of opportunity moving forward.

Infrastructure remains vital: Major projects, including HS2, Thames Tideway, and Hinkley Point C, will continue, providing sector growth despite many being late and over budget. The A303 Stonehenge Tunnel, greenlit by the Government earlier this year, will also offer extra opportunity within the industry.

Making it rain: Water proved the most significant growth market. Almost four in ten (37.1%) chose it as the strongest vertical. Why? Big water infrastructure. Projects coming online next year include large reservoir projects and an upcoming overhaul of the UK’s creaking wastewater infrastructure.

Acute recession expected: According to the Construction Products Association (CPA), whilst marginal costs have fallen slightly, prices are still higher compared to the start of the year, and market uncertainty persists. Interest rates remain high and are expected to stay that way, if not increase, for the foreseeable future.

Housebuilding depression: There have been persistent poor performance in many key verticals, particularly the private housing sector. Survey respondents anticipate a further decline in approvals, awards, and project starts. This sector is forecast to be the worst affected due to the increase in mortgage rates, leading to a fall in demand. However, whilst not immediate, future growth is expected, with a fifth predicting the market will rally in the near future.

Rocky roads: Whilst 25% of respondents expected the next 12 months to see an increase in projects, an equal amount predicted a decline. The rest remained undecided. This represents a 12% confidence decrease compared to 2022 levels. New projects are coming online, and delays are expected due to funding uncertainty and the decision to remove smart motorways from development frameworks.

Trouble on the tracks: Setbacks in HS2 are causing concerns, with the timings for investigation works on phases 2A and 2B needing clarification. Despite that, the project will continue to significantly impact the geotechnical sector well into next year and the year after. Again, funding remains in the balance on other projects, with many planned upgrades put on the back burner, particularly at TFL, where future activity has been paused due to financing issues.

Skills shortages: Once more, recruitment remains a massive headache. Over 80% of respondents claim it’s a significant problem, which should be concerning, considering over half agree that workloads are set to increase.

.png)